Agent assisted payments

CardEasy Agent Assist provides a secure and PCI DSS compliant payment solution for contact centers. It utilizes DTMF masking (keypad entry) and automated speech recognition to capture payment card data securely from your customers. Your agents and your customers remaining connected throughout the process which provides the best customer and agent experience, whilst reducing average handling time.

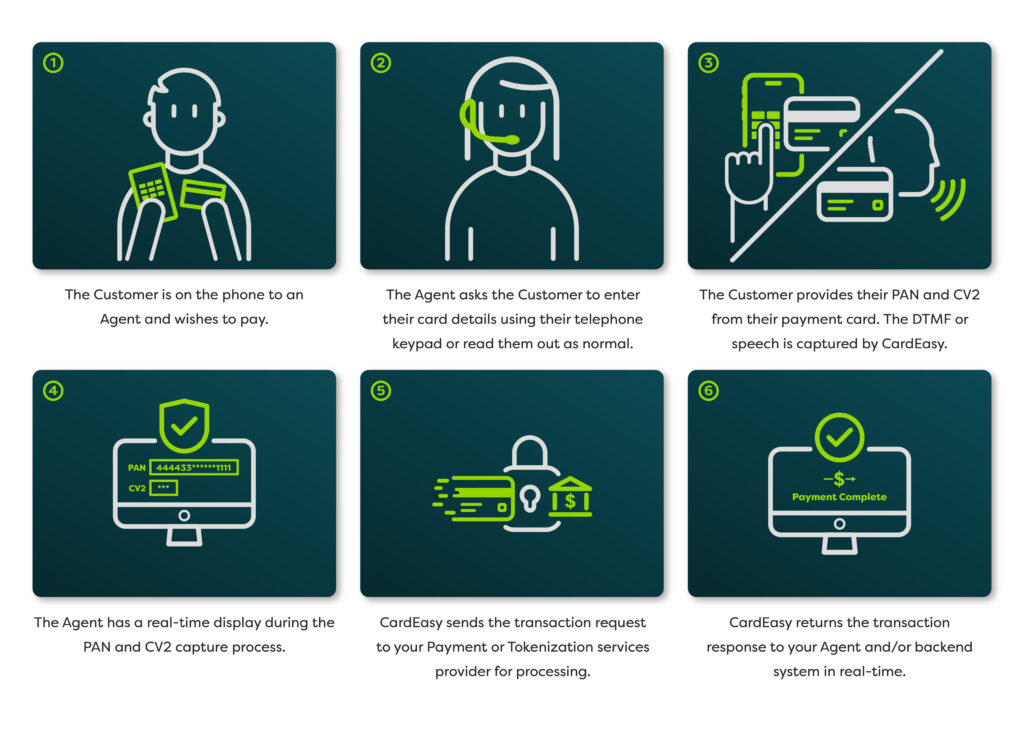

How CardEasy Agent Assist works

Using CardEasy Agent Assist, the contact center agent simply asks the customer to either:

- Enter their payment card numbers using their telephone keypad. CardEasy captures the keypad entries utilizing DTMF masking.

- Speak their payment card numbers aloud as they normally would. CardEasy captures the spoken numbers utilizing automated speech recognition (ASR).

Whether payment card data (which typically involves PAN, Expiry Date and CV2) is captured via DTMF or ASR, there is no requirement for the contact center agent to transfer the customer or put the customer ‘on hold’. This ensures a seamless, natural and positive customer and agent experience.

Your agents are able to maintain conversation with your customers at all times and can provide verbal guidance and instructions to the customer as necessary, meaning you are far less likely to suffer from abandoned payments which are common when agents are required to transfer customers to a self-service IVR for payment. Agent Assist can also help to reduce your contact center’s average handling time (AHT).

CardEasy Agent Assist – 6 steps to secure telephone payments

Key Benefits of CardEasy Agent Assist

Fully de-scopes both your contact center environment and full length call recordings from PCI DSS

- Provides your customers with reassurance that you are handling their payment card data securely, improving brand trust and protecting your reputation.*Quick and easy to deploy either as a fully cloud-based, on-premise or hybrid solution.

- Works just as effectively whether your agents are based in a physical contact center or working remotely, covering both in-house at outsourced agents.

- Works with all carriers, contact center platforms, CRM systems and payment and tokenization service providers (PSPs).

- The agent and customer remain connected throughout the payment card capture process, so the agent can provide assistance as required.

- No need for the agent to put the customer on hold or transfer them to an IVR to make payment, ensuring the best customer experience, fewer abandoned payments and reduced average handling time (AHT).

- Supports the capture of payment card data using either DTMF masking or automated speech recognition.

- BIN lookup (issuing bank), Luhn check (PAN validation), one-time, recurring and multiple payments, tokenization and multiple currencies are all supported.

- A low implementation charge and usage-based service charges mean that CardEasy is cost-effective and easy to budget for.

All CardEasy solutions are designed, developed and maintained by Syntec, a PCI DSS Level 1 service provider since 2011; Visa Merchant Agent; Participating Organization of the global Payment Card Industry Security Standards Council; and fully ISO 27001, 9001, 22301 and 14001 accredited.

More than just one solution

All the CardEasy secure payment solutions work seamlessly together, as well as integrating with your existing systems, ensuring that your customers receive a consistent and user-friendly payment experience whatever channel they decide to use.

Whether you choose to use CardEasy for agent assisted, IVR or digital payments (or all three), your customers’ payment card data is never seen or heard by your agents, or stored in your environment or call recordings, meaning your environment is fully de-scoped from the PCI DSS controls.