CardEasy overview

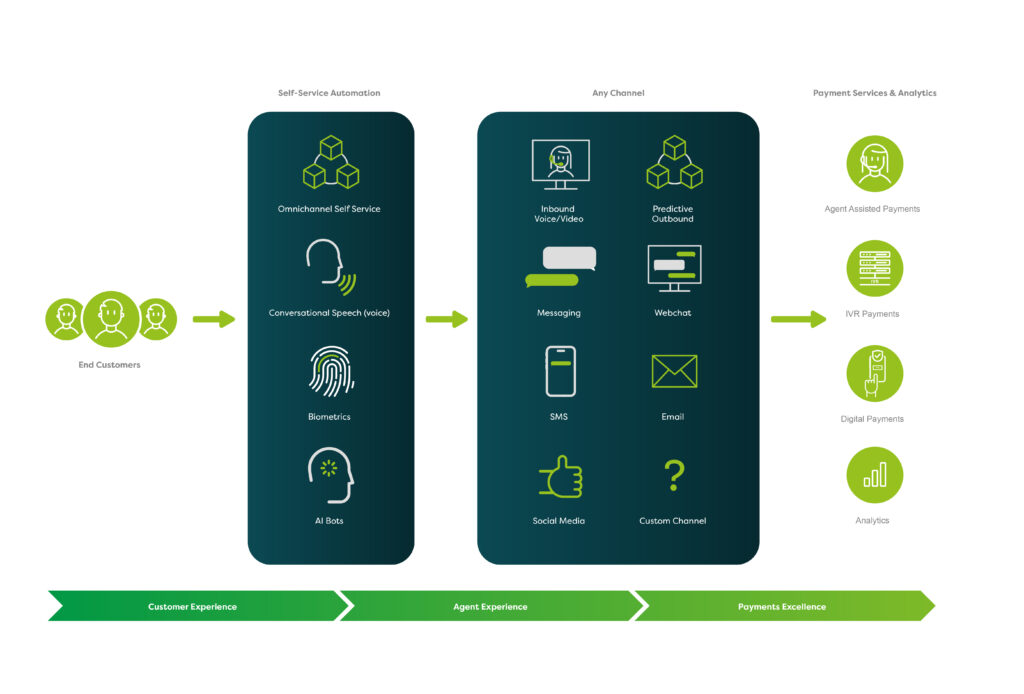

CardEasy enables you to de-scope your contact center environment and call recordings from PCI DSS, including both voice and digital channels. Seamless integration with your existing telephony and IT infrastructure reduces the risks and costs associated with managing compliant card payment transactions in your contact centers, whilst improving customer experience and trust.

How CardEasy works

Using CardEasy saves you time and money by taking your operations out of scope from PCI DSS controls, whilst removing the need for time-consuming oversight and PCI audits. Not only can it improve your call handing times and your customers’ experience, but setup costs are low, and ongoing managed service costs can be linked directly to your channel or agent utilization.