CardEasy for retailers

CardEasy enables retailers to de-scope their contact center environment and call recordings from PCI DSS, including both voice and digital channels. Seamless integration with existing telephony and IT infrastructure reduces the risks and costs associated with managing compliant card payment transactions in contact centers, whilst improving customer experience and trust.

Why CardEasy is the best option for retailers

CardEasy eliminates the risk of customers’ card details being breached by ensuring that they never enter the retailer’s contact center environment in the first place. Contact center agents are prevented from hearing or seeing payment card data and it is automatically blocked from screen and call recordings, without the need for a pause / resume function.

CardEasy also facilitates omnichannel retailing, enabling retailers to take secure payments through any channel, be it telephone (via live agent or self-service IVR), email, SMS, social media, web chat or any other digital channel.

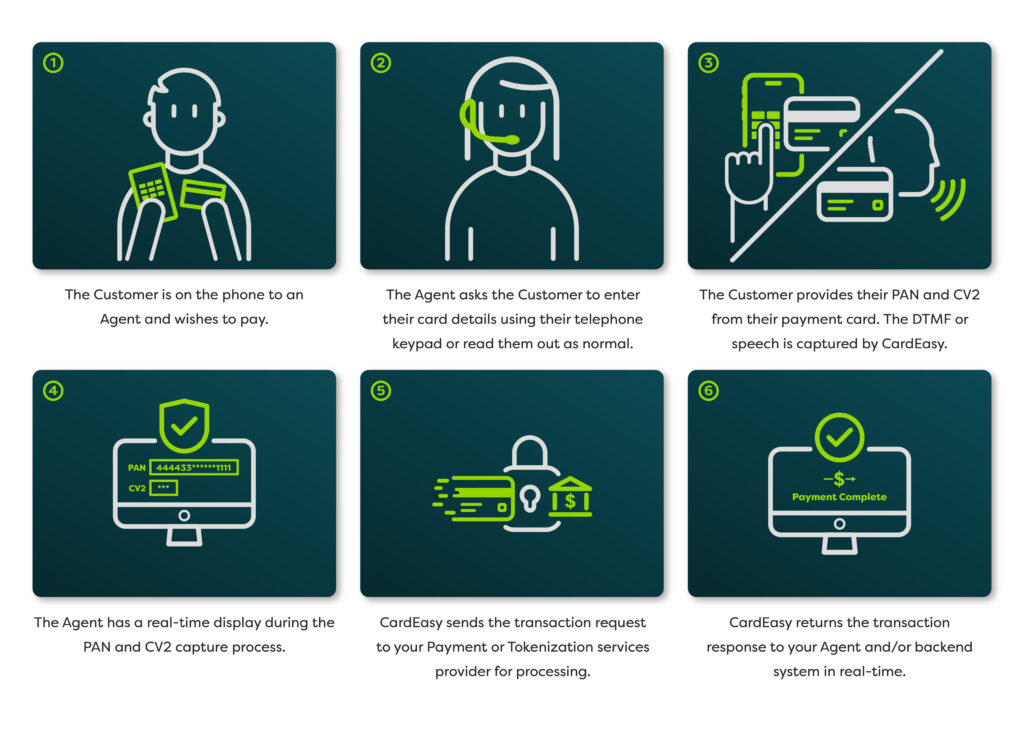

How CardEasy works

Download our free white paper to learn more

CardEasy retail white paper

"*" indicates required fields

What other retailers say about CardEasy

More than just one solution

All the CardEasy secure payment solutions work seamlessly together, as well as integrating with your existing systems, ensuring that your customers receive a consistent and user-friendly payment experience whatever channel they decide to use.nnWhether you choose to use CardEasy for agent assisted, IVR or digital payments (or all three), your customers’ payment card data is never seen or heard by your agents, or stored in your environment or call recordings, meaning your environment is fully de-scoped from the PCI DSS controls.